It’s been a rough week, what with new stadium demands dropping every couple of hours, half of them from Jerry Reinsdorf. But there have also been signs of new organized opposition from all corners, some of them involving heavy hitters:

- The Northern Virginia AFL-CIO came out against the proposed Washington Capitals and Wizards arena in Alexandria after being unable to reach an agreement with the teams and the state on whether a hotel that would be part of the $2 billion project would employ union workers. “If they’re against it, then the arena deal is probably going to have a very difficult time,” remarked Virginia House Speaker Don L. Scott Jr. afterwards, as the arena bill heads for reconciliation talks between the house, which passed it, and the senate, which didn’t even give it a hearing. “If it dies, it dies.”

- Virginia state Sen. Louise Lucas, meanwhile, upped the ante on her opposition to Alexandria arena plans, challenging D.C. Mayor Muriel Bowser on Twitter to “compete by both offering $0 in taxpayer dollars to these teams and let them decide where they want to pay to build their own arena.” (Bowser’s account did not respond, unless this counts.) Former Alexandria mayor Allison Silberberg, who is part of the Coalition to Stop the Potomac Yard Arena campaign, was so pleased that she brought Lucas a cake.

- After the Kansas City renters’ group KC Tenants came out against the upcoming April 2 referendum to renew Jackson County’s 0.375% sales tax surcharge and give the money to Royals owner John Sherman as part of a potential $1 billion in public money for a new downtown stadium, calling it “$167 per household, per year, all to pay for a playground for the wealthy and for tourists,” a group of city residents have formed the Committee Against New Royals Stadium Taxes to likewise oppose the tax hike. The group has “little to no money in its bank account,” according to the Kansas City Star’s account of campaign manager Tim Smith’s characterization, but it does have a parked domain name and its organizers are members of the extremely active Save Kauffman (Royals) Stadium at Truman Sports Complex Facebook group, which is a recommended follow if you want to see how extremely angry many Kansas City residents, and Royals fans, are about this whole state of affairs.

- Arthur Acolin, a real estate economics professor at the University of Washington, released a three-page report on the proposed downtown Philadelphia 76ers arena that found that disruptions to existing businesses during construction and operation could cost the city and state between $260 million and $1 billion in lost tax revenues. The math is a little rough — it looks like Acolin just added up all the economic activity in the area of the proposed arena and calculated what would happen if it fell by sample round numbers — but as he writes, “the 76ers have provided nowhere near this level of details nor any of the analysis behind their figures.” It was enough to get the 76ers to respond by calling the report “fatally flawed” and “another attempt by those who oppose the project to obfuscate the truth by pumping out misinformation and half-baked theories instead of engaging in productive dialogue,” in a CBS News article that repeatedly refers to Acolin as “Albert Alcoin,” which should get all their copy editors immediately fired, if they had copy editors, which they probably don’t.

- Arizona Republic sportswriter Greg Moore wrote a column about Diamondbacks owner Ken Kendrick’s threat to leave town if he doesn’t get public stadium money that includes the subhead “I don’t like bullies,” and really the rest of the column is just icing on that four-word cake.

- I brought my mighty rhetorical weight to the airwaves, or at least the internetwaves, by going on the Sox Machine podcast to talk about why giving Reinsdorf $1.7 billion in tax money for a new Chicago White Sox stadium development (since upped to $2 billion) would be crazytown.

So that’s it, then, the tide is finally turning, and maybe soon we can all stop pushing this damn rock back up this damn hill day after day? Hahaha of course not, the forces of vacuuming up money and giving it to rich people so they can have more money (because that’s what makes them rich people) continue unabated:

- The Utah legislature advanced a bill to hike sales taxes in Salt Lake City by 0.5% to generate $1 billion for an arena for a nonexistent NHL team, with the backing of Mayor Erin Mendenhall. This would be on top of $600 million or more in proposed hotel tax hikes to help pay for a stadium for a nonexistent MLB team. Hockey bill sponsor state Sen. Dan McCay denied that this was giving in to threats by the Jazz ownership that they could move out of the city limits without a new subsidized arena, then added, “you’d hate to see downtown lose the sporting opportunities they have now,” so, yeah.

- Chicago Mayor Brandon Johnson delivered up a fresh bowl of word salad about whether he’ll endorse city money being used for a new White Sox stadium: “As far as public dollars, we haven’t gotten into any of those specifics just yet. But I will say that we’re gonna explore all options. … Everything is on the table here. But again, I want to make sure that there’s a real commitment to public use and public benefit. … There’s no guarantee that they’ll get it from the city. What I’ve said repeatedly is that we need to make sure that our investments have real public benefit and that there has to be a commitment to public use. Those conversations are being had, and there are some promising developments that eventually we’ll be able to talk about out loud.” He has it right here on this list…

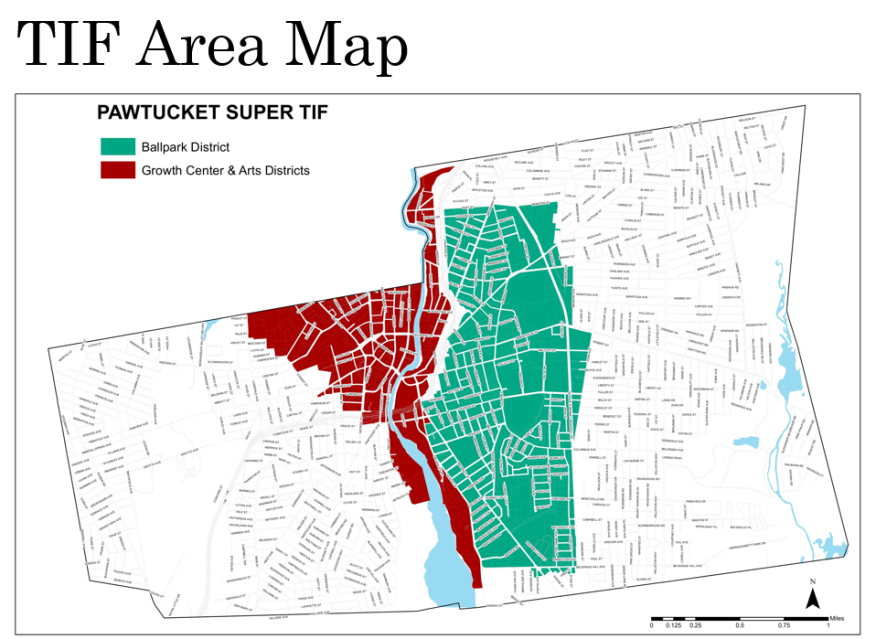

- The new $27 million Rhode Island F.C. soccer stadium in Pawtucket will now cost state taxpayers $132 million over 30 years, because the Pawtucket Redevelopment Agency got a terrible bond rate. State commerce secretary Liz Tanner defended the pricey borrowing by pointing out that even though the state legislature could have just appropriated the money and saved taxpayers a ton of interest payments, “there would’ve been a level of uncertainty without knowing whether the legislature was going to pass those dollars or not,” and we can’t have that, now can we?

- The Dodger Stadium gondola project — surely you remember the Dodger Stadium gondola project — lurched forward again on Thursday when the Metro Board of Directors signed off on its environmental impact report. The gondola still needs approval from the city of Los Angeles and parks and transit officials, plus to figure out who exactly will pay for its potential $500 million price tag, but if nothing else it lives to gondola another day.

- Oakland A’s owner John Fisher is reportedly focused on staying in Oakland until a new Las Vegas stadium is open in 2028, and also Sacramento is the frontrunner to be the temporary home of the A’s, this is way too blind-men-and-the-elephant for me, maybe let’s all calm down about the latest rumors you heard, guys.

- And in non-sports news, Louisiana Gov. Jeff Landry defended signing a bill to remove the requirement that recipients of state development subsidies report how many jobs they’ll be creating, because “this program is about capital investment. It is not about job creating.” Just gonna sit here and let that roll around in my brain for a while, have a great weekend and see you back here Monday!